Chinese President Xi Jinping’s recent three-nation tour of Southeast Asia, spanning Vietnam, Malaysia, and Cambodia from April 14 to 18, 2025, marks a significant diplomatic push to bolster China’s influence in the region. Arriving in Malaysia on April 15, Xi aimed to deepen economic and political ties, particularly through discussions on a free trade agreement between China and the Association of Southeast Asian Nations (ASEAN), chaired by Malaysia this year. This tour, Xi’s first overseas trip of 2025, comes amid heightened U.S.-China trade tensions, presenting China as a stable economic partner in contrast to the United States’ recent tariff policies. This article expands on Xi’s visit, exploring its objectives and analyzing its broader implications for the United States.

Xi’s tour began in Vietnam, where he met with Communist Party General Secretary To Lam and President Luong Cuong, signing 45 cooperation agreements on trade, supply chains, railways, artificial intelligence, and green energy. These deals aim to enhance Vietnam’s role as a manufacturing hub, leveraging Chinese investments to diversify supply chains amid U.S. tariffs. Xi also visited the Ho Chi Minh Mausoleum, reinforcing cultural ties.

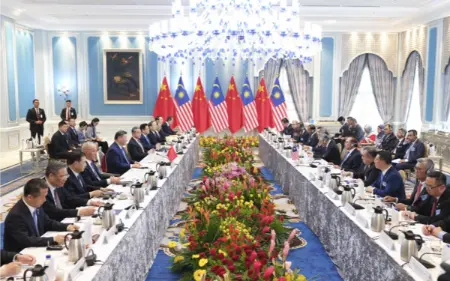

In Malaysia, Xi was welcomed by Prime Minister Anwar Ibrahim and met with King Sultan Ibrahim Iskandar. The visit focused on strengthening bilateral trade, with China as Malaysia’s largest trading partner since 2009, boasting a trade value of $110 billion in 2024. Xi and Anwar witnessed the exchange of 31 agreements covering trade, tourism, railway transportation, and agriculture, including increased access for Malaysian agricultural products like durians to the Chinese market. Xi emphasized resisting geopolitical confrontation, unilateralism, and protectionism, advocating for a UN-centered multilateral trade system.

The tour concluded in Cambodia, a staunch Chinese ally, where Xi aimed to reinforce economic and infrastructure ties, including the recently completed China-backed Techo International Airport. Cambodia’s reliance on Chinese investment, particularly in the Belt and Road Initiative (BRI), underscores its strategic importance.

Xi’s overarching message was clear: China positions itself as a reliable partner, offering stability and economic cooperation in a region reeling from U.S. tariff shocks. He urged ASEAN nations to resist decoupling and supply chain disruptions, contrasting China’s openness with U.S. protectionism.

The timing of Xi’s tour is critical, coinciding with escalating U.S.-China trade tensions under President Donald Trump’s second administration. The U.S. imposed a 145% tariff on Chinese goods effective April 9, 2025, while temporarily suspending reciprocal tariffs on Southeast Asian nations like Vietnam (46%), Malaysia (24%), and Cambodia (49%) for 90 days. These tariffs, aimed at addressing trade imbalances, have disrupted global markets and forced ASEAN countries to seek alternative markets to mitigate economic fallout.

China, facing significant export challenges due to U.S. tariffs, is accelerating efforts to secure Southeast Asian markets. Posts on X suggest China’s exports are “cratering,” prompting Xi to “lock down allies fast.” Southeast Asia, as ASEAN, has overtaken the U.S. and EU as China’s largest export market since 2023, with Vietnam alone seeing trade with China nearly double from 2017 to 2024. This economic interdependence makes the region a strategic buffer against U.S. trade restrictions.

However, Southeast Asian nations face a delicate balancing act. While welcoming Chinese investment, countries like Vietnam and Malaysia are wary of antagonizing the U.S., their primary export market. Malaysia, for instance, relies on the U.S. for electronics exports, while Vietnam’s exports to the U.S. account for 30% of its GDP. Both nations are negotiating tariff reprieves with Washington, making Xi’s visit a diplomatic tightrope.

Xi’s tour has significant ramifications for the United States, affecting its economic, geopolitical, and strategic interests in Southeast Asia.

The U.S. tariffs have inadvertently strengthened China’s economic influence in Southeast Asia. By presenting itself as a stable alternative, China is capturing markets that might otherwise rely on U.S. trade. For instance, Malaysia’s push to export more electronics, palm oil, and halal products to China could reduce its dependence on the U.S. market. This shift threatens U.S. exporters, particularly in agriculture and technology, as Chinese demand for Southeast Asian goods grows.

Moreover, the U.S. risks losing market share if Southeast Asian nations redirect exports to China to offset tariff losses. Vietnam’s agreement to use Chinese loans for railway projects and Malaysia’s integration into BRI projects like the $10 billion East Coast Rail Link signal deeper economic alignment with China. These developments could divert trade flows away from the U.S., impacting American businesses and increasing trade deficits with ASEAN countries.

The flood of cheap Chinese goods, redirected from the U.S. market due to tariffs, also poses a challenge. Southeast Asian nations fear being overwhelmed by these goods, which could undermine local industries and indirectly affect U.S. exports to the region. This scenario could depress regional economies, reducing demand for U.S. products.

Geopolitically, Xi’s tour challenges U.S. influence in Southeast Asia, a region critical to countering China’s assertiveness in the South China Sea. Posts on X suggest that stronger Malaysia-China ties could encourage other ASEAN nations to align with Beijing, weakening the U.S. position in the trade war. The U.S. has long relied on ASEAN as a security partner to balance China’s regional ambitions, but Xi’s charm offensive undermines this dynamic.

Malaysia’s and Vietnam’s cautious engagement with China, while negotiating with the U.S., highlights the risk of a fragmented ASEAN. If ASEAN nations prioritize Chinese partnerships, the U.S. could face a less cohesive regional bloc, complicating efforts to build a united front against China’s territorial claims. Cambodia’s alignment with China, bolstered by military and infrastructure support, further tilts the regional balance.

Xi’s advocacy for a UN-centered system and multilateral trade, as noted in X posts, positions China as a defender of global norms, contrasting with the U.S.’s unilateral tariff approach. This narrative could erode U.S. credibility among developing nations, particularly in the Global South, where China and Malaysia share affiliations.

Strategically, the U.S. faces challenges in maintaining its role as a reliable partner. The erratic nature of Trump’s tariff policies—imposing then pausing tariffs—has sown confusion and distrust among ASEAN nations. Xi’s tour capitalizes on this uncertainty, depicting the U.S. as an unpredictable actor. This perception could weaken U.S. alliances, particularly with Malaysia, which Prime Minister Anwar Ibrahim has called a “true friend” to China.

The U.S. also risks losing technological influence. China’s push for cooperation in AI and green energy with Vietnam, and its approval of COMAC passenger jets in Vietnam, signals an intent to expand technological footprints. If Southeast Asian nations adopt Chinese standards and technologies, U.S. tech companies could face exclusion, impacting long-term competitiveness.

Xi’s tour underscores a broader contest for global leadership. By positioning China as a champion of free trade and stability, Xi challenges the U.S.-led economic order. The U.S.’s focus on tariffs, while aimed at protecting domestic industries, risks alienating allies and driving them toward China. This shift could weaken the U.S.’s ability to shape global trade rules and standards.

Furthermore, China’s success in Southeast Asia could embolden it to expand influence in other regions, such as Africa and Latin America, where the U.S. also competes for influence. The U.S. must navigate this challenge carefully, balancing protectionist policies with the need to maintain alliances.

To counter China’s growing influence and mitigate the fallout from Xi’s tour, the U.S. should consider the following:

1. Engage ASEAN Diplomatically: The U.S. should increase high-level visits to Southeast Asia, reinforcing commitments to trade and security partnerships. A clear, consistent trade policy would rebuild trust eroded by tariff volatility.

2. Offer Tariff Concessions: Negotiating tariff reductions with Vietnam, Malaysia, and Cambodia could prevent them from pivoting fully to China. Incentives like trade agreements or investment packages could maintain U.S. market access.

3. Invest in Regional Infrastructure: Competing with China’s BRI, the U.S. could support infrastructure projects through initiatives like the Partnership for Global Infrastructure and Investment, focusing on sustainable and transparent projects.

4. Strengthen Technological Cooperation: The U.S. should promote tech partnerships, offering alternatives to Chinese AI, green energy, and aviation technologies to maintain influence in emerging sectors.

5. Counter China’s Narrative: Public diplomacy efforts should highlight U.S. contributions to ASEAN’s development, emphasizing shared values like democracy and innovation to contrast with China’s authoritarian model.

Xi Jinping’s Southeast Asia tour is a strategic move to cement China’s role as a regional leader amid U.S.-China trade tensions. By securing trade agreements, reinforcing infrastructure ties, and presenting China as a stable partner, Xi challenges U.S. influence in a critical region. For the United States, this tour underscores the need to reassess its trade and diplomatic strategies. Failure to engage effectively with ASEAN could cede economic and geopolitical ground to China, with lasting implications for U.S. global leadership. By balancing protectionism with proactive engagement, the U.S. can maintain its relevance in Southeast Asia and beyond.